A spreadsheet full of numbers or an app blinking with notifications can stop you cold. Too many options sit there, each one a possible mistake or a missed chance. The easiest response is to close the tab and walk away.

Trying to pick the single best move often means you make no move at all.

Your brain is just doing its job with all that complexity.

Getting unstuck means fiddling with the information, not collecting more of it. Financial confidence grows the way you learn a city—by walking the same streets again and again. You notice the shop on the corner, the cracked pavement. Soon, you’re not checking a map every time. You just know how the blocks connect.

Finelo: The Structured Drill Instructor

Finelo.com tackles overthinking with a clear, daily schedule, serving up short lessons and a specific challenge each day. This structure removes the exhausting question of “what should I learn today?”

More than just lessons, its investing simulator acts as a dedicated practice field. You get a virtual portfolio to test strategies with real-market data but without real risk. This is where the fear of being wrong gets dismantled. Making a trade that loses play money and seeing the chart dip teaches you about volatility in a way a textbook never could.

You get used to the feeling of a chart dipping south. That tightness in your chest loosens its grip over time. The app’s daily counters and scoreboards make opening it feel normal, like brushing your teeth. It becomes something you just do, not a big production you have to mentally prepare for.

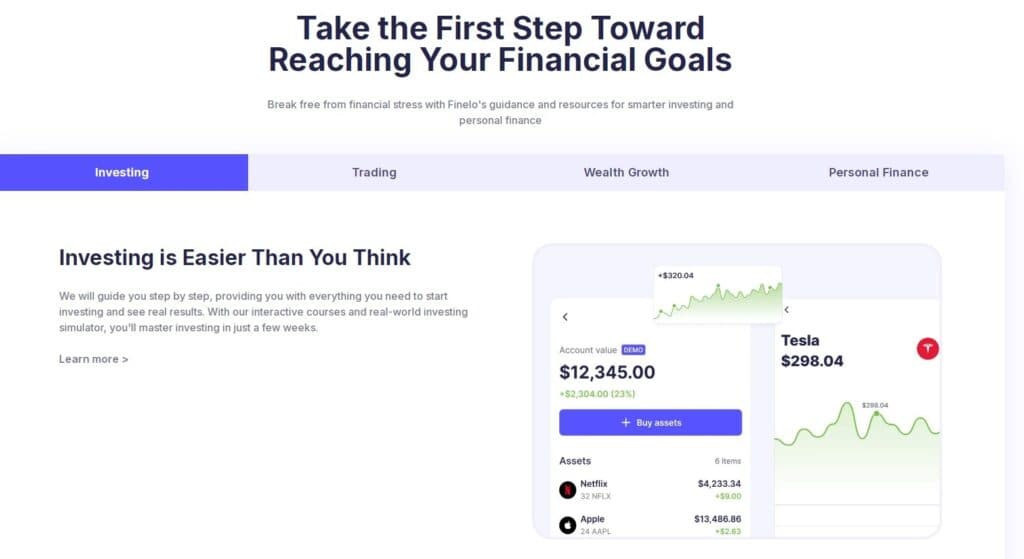

Intuit for Education: The Real-World Simulator

This service, the one behind TurboTax, drops you into someone else’s financial shoes for a little while. One simulation casts you as a student figuring out college, making you pick a meal plan and decide whether to find a part-time job.

You watch your digital wallet shrink or grow with every choice. Deciding on the fancy coffee every single morning might mean your virtual friends head to a movie that you can’t afford to join. That’s the moment you learn what “opportunity cost” really means—not from a textbook’s bullet point, but from the dull feeling of missing out on something fun.

The lesson gets wired into your system through that small disappointment. Later, when a similar spending choice pops up in your own life, it feels familiar and recognizable, not like a surprise pop quiz you didn’t study for.

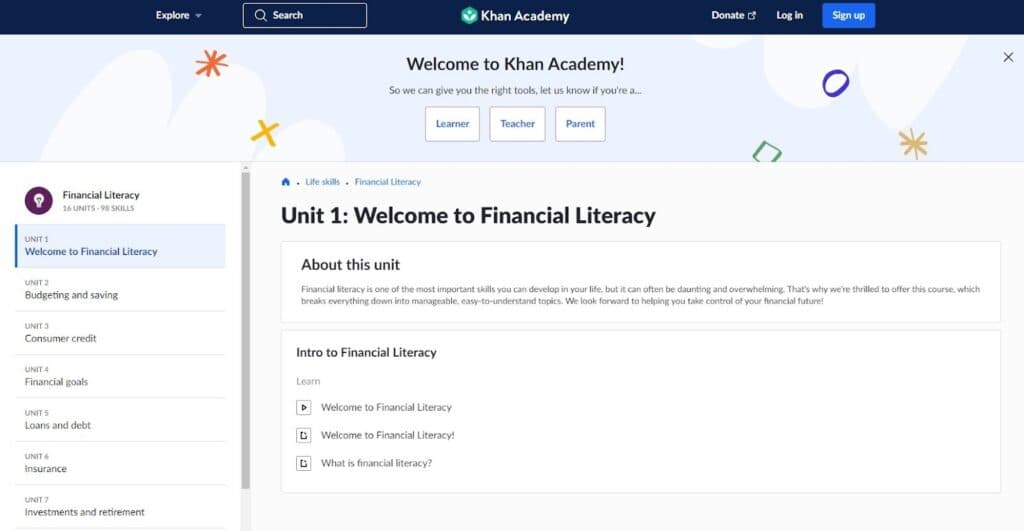

Khan Academy: The Patient Tutor

Khan Academy works like a library that’s always open, with no due dates and no librarian keeping score. Its best feature is how it just waits patiently for your specific question to arrive. A term like “diversification” might come up in a conversation and tie your stomach in a knot.

You type it into the search bar, and a short video pops up with simple drawings and a calm voice that explains it in plain language. That single act stops one confusing question from blowing up into a thick cloud of general dread about the whole topic.

Your understanding of money builds piece by piece this way, one clarified term at a time, whenever you personally decide you’re ready to look something up. You completely call the shots on what to learn next, following your own confusion wherever it leads.

Zogo: The Habit Builder

Zogo understands that building a new habit often needs a little external spark. It slices financial literacy into hundreds of pill-sized modules, each a five-minute read and a quick quiz.

The unique hook is earning pineapples (their reward points) for every module finished, which can be cashed in for real gift cards. This direct, tangible reward system cleverly hacks your brain’s motivation centers. Learning about Roth IRAs becomes a small, rewarding game with an immediate payoff.

The heavy idea of “learning finance” melts away. You’re just ticking boxes and collecting points for a reward. Your attention moves from a scary, giant project to the simple click to finish a lesson. It tucks a bit of money knowledge right into your phone time between social media and messages.

The Anatomy of a Financial Decision

Let’s break down what actually happens in your mind during a single financial choice. It’s rarely a clean, logical process. There’s the initial spark—an idea, a fear, an opportunity. Then, a flood of questions. Your mind starts looping. Is now good? What door closes if I open this one? How bad will it hurt if my guess is off? This is the noise that causes paralysis.

These platforms work by quieting different parts of that noise. A simulator like Finelo or Intuit tackles the “what if I’m wrong?” fear by letting you be wrong safely. A daily lesson from Zogo or Finelo systematically answers the “what is this?” questions over time, so they don’t all scream at you at once. The on-demand library of Khan Academy gives you a tool to instantly quiet a specific, nagging question.

Imagine your decision-making is a dirty window. Right now, it’s covered in the grime of second-guessing and questions. Every time you use one of these tools, you wipe one small, clean spot on the glass. After a while, you notice you can see shapes through it. The view outside isn’t perfect, but you can tell which way to walk. That clarity comes from all those small, individual wipes.

The Power of a “Practice Portfolio”

One of the most effective tools against overthinking is something you can create yourself: a dedicated “practice portfolio.” You leave your wallet completely out of it. The entire process lives on a notepad or in a private document, a space for you to track choices that carry no financial weight.

Here’s how it works:

- Pick three or four assets you hear about—a well-known stock like Apple, a popular ETF, and maybe a cryptocurrency.

- Every day or week, you make a simple “buy,” “sell,” or “hold” decision for each based on a glance at the news or their price charts.

- Write down your reasoning in a sentence. “I think Apple will drop because of the new product announcement,” or “I’ll hold the ETF because the market seems steady.”

- The point is to practice the act of making a choice and then living with the consequence, even a hypothetical one. You’ll notice that some of your guesses will be wrong. A stock you sold might go up.

- This is the most valuable part. You get to feel the sting of a missed opportunity in a completely safe space. Slowly, this habit pulls the feeling out of the result.

You see that a choice made sense with what you knew at the time, even if things didn’t turn out great. You build a quieter, more logical part of your mind that doesn’t freak out about being incorrect. You’ve already been incorrect plenty in your practice space, and the world kept spinning.

One Last Thing

Confidence doesn’t arrive in a box. You build it brick by brick when nobody’s watching.

These apps are just gyms for that. They give you a room to trip over your own feet without anyone laughing. The assurance you feel later comes from all those tiny rehearsals. You’ve already faced a version of this dilemma in a safer place.

Find the one that feels easiest to open. Use it for a handful of minutes. You will still get stuck in your own head sometimes. The trick is having a quiet, familiar way to find your way back out.